Bitcoin’s hash rate dropped by significantly last week. This was the single largest one-day drop in mining hash rate since November 2017 that was enough to trigger mayhem in the cryptocurrency market as the week ended.

This was due to the Xinjiang power outage, which caused an electrical grid blackout, causing Bitcoin’s hash rate to decline. It is worth noting that this territory in northwest China powers a substantial amount of the Bitcoin mining network.

Over the weekend Bitcoin’s price also crashed prompting million in liquidation. However, the price dropped on the 16th of April and preceding the drop of the network’s hash rate. Moreover, reports emerged that speculated that mining farms in Xinjiang were closed on the same day due to a coal mine accident earlier in the week

Contrary to popular notion, many experts in the community believe that Bitcoin’s hash rate was not slashed by half, rather they opined that the figure declined by only 20% and that this was not the reason for the downsizing of the crypto-asset. One such is the Co-founder and the CEO of Blockstream, Adam Back who clarified,

“hash rate has never been above 168 EH, and last week’s low from power station failure is 124 EH. people are misreading/relying on graphs which are wrongly extrapolating too short sample periods from high variance block-interval.”

But not everyone was reached the same consensus.

Willy Woo’s Remark On Bitcoin Hash Rate Affair

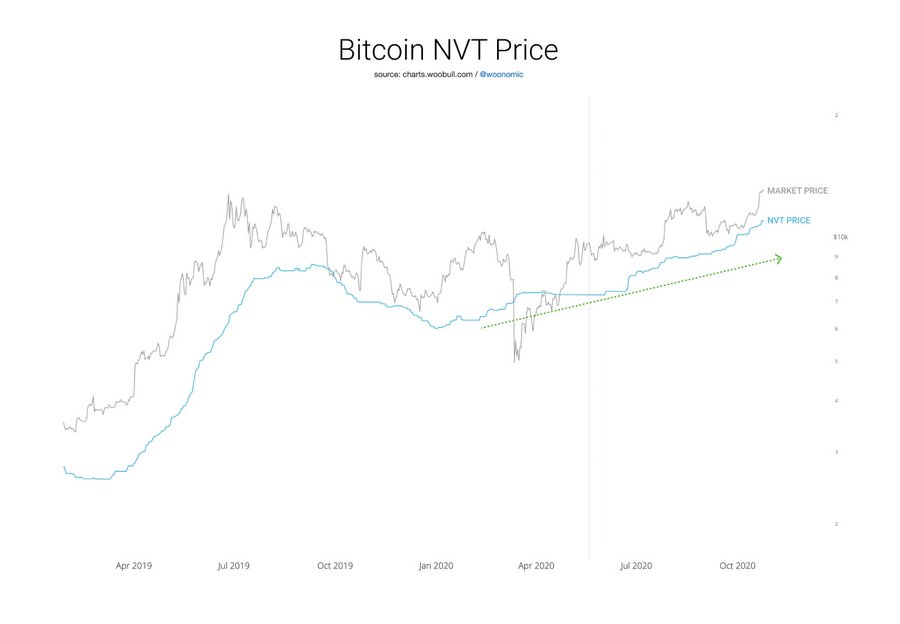

Willy Woo, the popular on-chain data analyst is of the opinion that the crypto-asset’s price and hash rate have always been correlated. Woo went on to explain that 9000 BTC was sent into Binance, on the same day as of the price crash.

While acknowledging that Binance more serves volume from Asia than the West, he speculated that the amount was sent in from a whale with “closer knowledge to happenings in China”. Delving more into details, Woo also said that the market-wide meltdown was compounded by the sell-off of quarterly futures on derivative markets which was already underway as early as 13th April.

“The two combined sell pressures were sufficient to tip the price below liquidation levels ($59k). This triggered a cascade of automatic sell-offs in a chain reaction.”

Taking into account the latest hash rate stats on a 6h moving average, Woo stated that the metric has mostly been fully recovered and also asserted that this event could potentially be a huge buying opportunity for market participants that are seeking to enter the space.