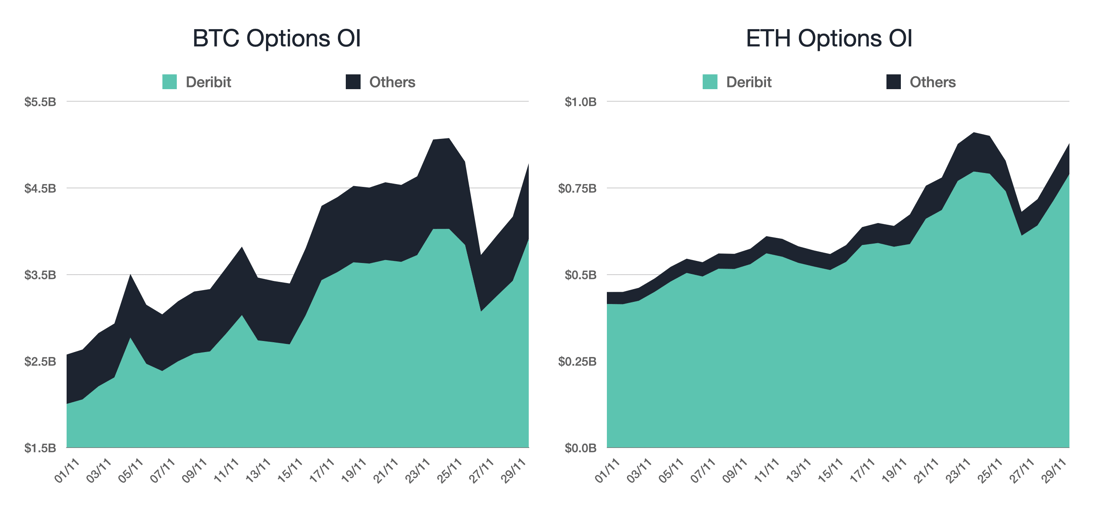

The options markets for both Bitcoin and Ethereum are experiencing a significant boom, spurred by positive developments in the spot BTC events. According to Laevitas, a prominent data analytics platform, there has been a substantial increase in the notional open interest of active BTC and ether options contracts on Deribit, the world’s largest options exchange, surpassing a remarkable $20 billion. This surge exceeded the previous peak noted on November 9, 2021, when Bitcoin was trading at an impressive $66,000, indicating a substantial 90% increase from the current market rate of $34,170.

Options are intricate derivative contracts that provide buyers with the right, though not the obligation, to buy or sell the underlying asset at a predetermined price before a specific date. In the context of Bitcoin options, a call option provides the right to buy, signifying a bullish stance, while a put option grants the right to sell, indicating a bearish perspective.

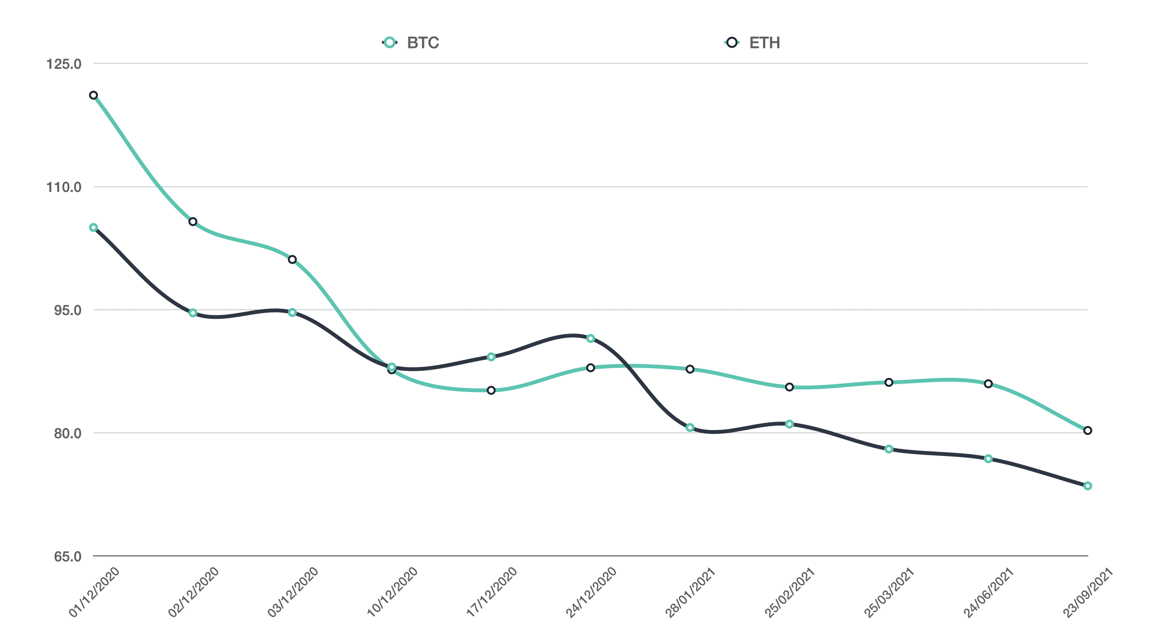

Analysts have observed that options trading typically attracts a more professional audience in comparison to futures trading, resulting in fewer retail investors engaging in this segment of the crypto market. This surge in options market activity suggests that the flows associated with investors and market makers will wield significant influence in determining the spot market price.

Crucially, recent reports have indicated that market makers have maintained a net short-gamma exposure to Bitcoin [ how sensitive an option’s price is to changes in the price of the underlying asset]. To balance their overall exposure, they may have acquired the flagship crypto, inadvertently fueling the ongoing price rally. Over the past fortnight, Bitcoin has experienced a remarkable surge of 30%, reaching a trading value exceeding $34,000.

Bitcoin’s Rally Sparks Short Squeeze Frenzy

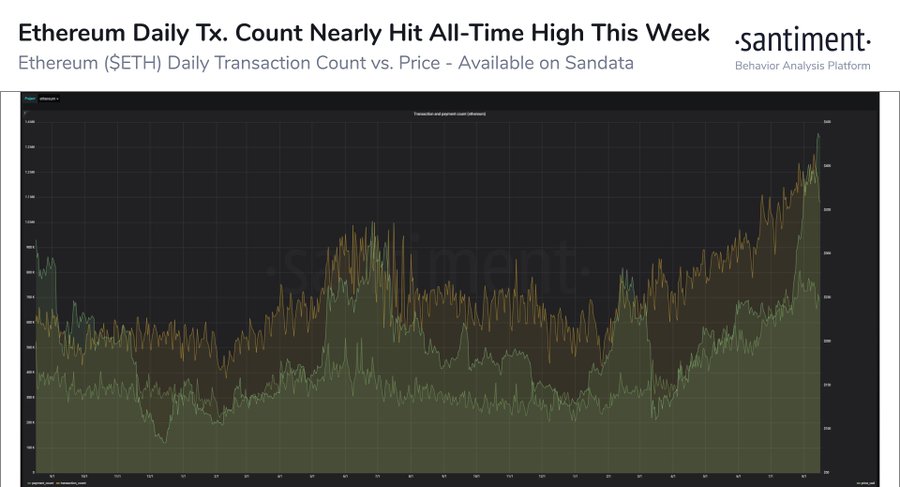

The week commenced on a robust note, with Bitcoin’s price surpassing $35,000 on October 24. Bradley Duke, Chief Strategy Officer at ETC Group, suggested that this activity triggered a wave of large leveraged short positions, leading to a short squeeze—where short sellers collectively closed out their positions. “Only time will reveal if this rally is sustainable, but it appears that enthusiasm for Bitcoin is making a comeback,” he remarked.

Conversely, open interest for Bitcoin futures initially receded due to these liquidations, resulting in a market value reduction of approximately $1 billion. However, this decline has since reversed, indicating the opening of new contracts post-rally, as noted by Aditya Jalan, APAC Trading Manager at FalconX. This dynamic market movement suggests an evolving landscape for cryptocurrency, with both professional investors and retail traders closely monitoring the ongoing developments.