- Analyst predicts Ethereum could hit $7,000, signaling the start of a new bullish cycle.

- President Trump’s $42M ETH investment fuels speculation of an imminent market move.

- Ethereum’s consolidation at $3,200 sparks “last chance to buy” calls before a potential breakout.

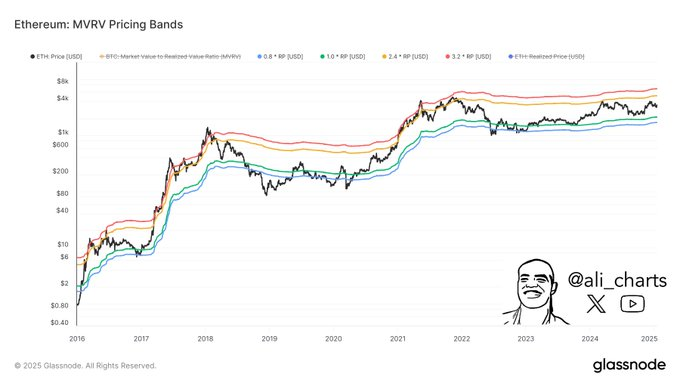

Ethereum, the largest altcoin, is now at the center of a bullish storm. Renowned analyst Ali Martinez has made a significant observation about ETH using the Market Value to Realized Value (MVRV) metric. MVRV compares ETH’s current market price at which the coins were last moved. This is a valuable tool for assessing the potential overvaluation or undervaluation of an asset.

Based on historical data, Ali has identified a recurring pattern. Whenever Ethereum’s price has traded above the 3.2 MVRV band during past bull runs, it has fueled significant price appreciation. Currently, this crucial level sits at $7,000.

This observation suggests that if ETH’s price surpasses the $7,000 mark, it could signal the onset of a new bullish cycle. This analysis not only provides valuable insights, it also supports the optimistic outlook. ETH’s $3,200 consolidation even fuels “last chance to buy” calls ahead of a potential breakout. Some experts even hinted that ETH is poised to climb towards $3,800–$4,100 in the near term.

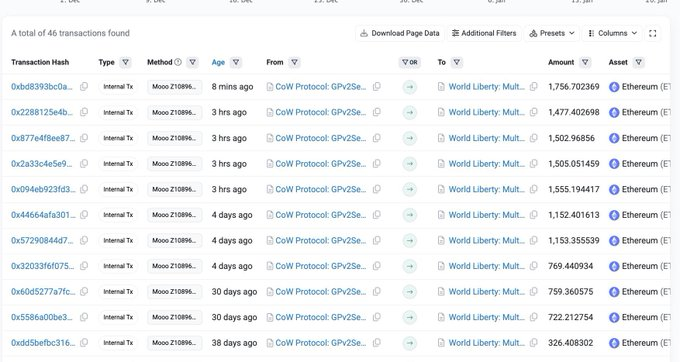

Notably, this forecast comes as U.S. President Donald Trump continues to buy the token. On-chain data shows that Trump has reportedly purchased $16 million worth of Ethereum, adding to his previous $26 million acquisition. The total $42 million buy-in has sparked widespread speculation about an imminent market move.

Ethereum’s Road to $10K?

Most importantly, the timing has prompted many to speculate that Trump’s strategic investments are to capitalize on ETH’s price momentum. This could likely propel it toward the much-anticipated $10,000 mark. While this theory lacks concrete evidence, the heightened interest underscores Ethereum’s dominance in the crypto space.

The ETH/BTC pair also presents an opportunity for Ethereum to outperform Bitcoin, with Bitcoin nearing local resistance levels. Market participants expect ETH to gain ground, particularly as the narrative surrounding its scalability and utility continues to evolve.

With technical strength, high-profile endorsements, and growing market attention, Ethereum appears primed for a bullish rally. Investors, however, should stay vigilant as short-term volatility could offer both risks and rewards.