Ethereum is exhibiting a similar kind of flair, reciprocated during the start of 2020.

The asset has been steadily recovering since its catastrophic drop in Mid-March but April has rejuvenated its position in the charts. According to Coinmetrics’ recent report, the largest altcoin has been the strongest performer in the chart for the 2nd straight week.

The CMBI Ethereum index indicated positive returns of 10.4 percent in the industry and on the other Bitcoin’s CMBI metric was completed neutral with 0 percent returns in valuation. The CMBI index is calculated on the basis of price performance and the general increase in terms of market activity, and for the 2nd consecutive week, Ethereum had the upper hand over Bitcoin.

The report further stated,

“The small-cap assets yielded the highest returns for the week, with the Bletchley 40 returning 7.1%, followed by the Bletchley 20 (mid-cap assets) which returned 6.2%.”

Additionally, it was mentioned that the top performer of the even index was the Bletchley 40 Even when incurred positive returns of 6.4 percent.

Now, Bitcoin did show a signs recovery in the chart with daily active addresses rising up to 12.1 week-over-week but it was not enough to outshine Ethereum in the industry.

Ethereum’s short-term positive phase could be cut short in the future

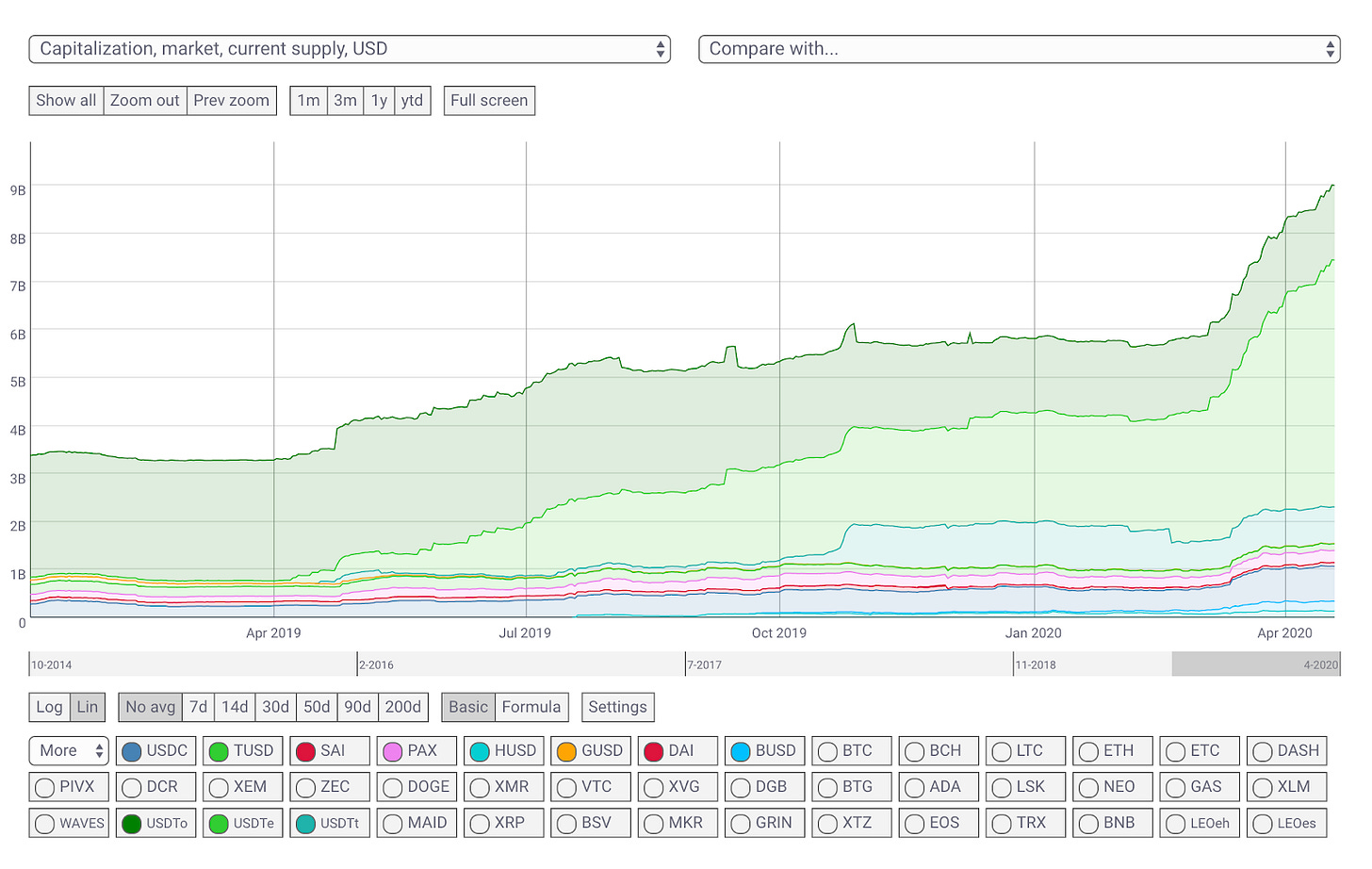

Since the start of April, Stablecoins have gained another 1 billion in the market and the growth has continued to arrive from Tether, and Ethereum has been the largest benefactor of this move. Tether issued on Ethereum (USDT_ETH) which went from a market cap of $4.43B on April 1st to $5.14B on April 19th.

The report added,

“USDT_ETH transfer count has been growing faster than both BTC and ETH over the last 180 days. Although BTC and ETH both still have significantly more daily transfers, USDT_ETH transfer growth has had a noticeable uptick since mid-March.”

Now, it is already evident that ETH has been leading all the large-cap asset with an approximate hike of $14 percent over the week. However, many had started to speculate in the space, whether the stablecoin growth is good or bad for ETH.

Depreciation in Ethereum’s monetary premium?

Now, on paper the advantage for Ethereum was clear. The increased issuance of stablecoins of the ETH network would bring significant liquidity. Stablecoin growth would increase the demand for ETH as well since every stablecoin transaction requires ETH for transaction fees.

However, as the utilization of stable asset increases on Ethereum, the monetary premium of ETH might drop and Ethereum’s credibility as money with crypto space will be diminished.

With stablecoins possessing the potential to be a stable asset and accruing characteristics of a medium-of-exchange, it may leave Ethereum’s use-case in the rear-window within the community.

It is still early to draw a conclusion but it is imperative to keep an eye over this space over the next few months.