Last month, Bitcoin went down in history for the wrong reasons. On 12th March 2020, when a collective collapse took place over the global financial industry, Bitcoin mirrored the traditional asset class as well and its valuation dropped by nearly 50 percent in the charts.

In Coinmetrics’ recent report, the impact of the price drop on the crypto industry was analyzed and the problems with BitMEX’s liquidation which possibly amplified the drop more than it should have.

Transaction Fees collapse

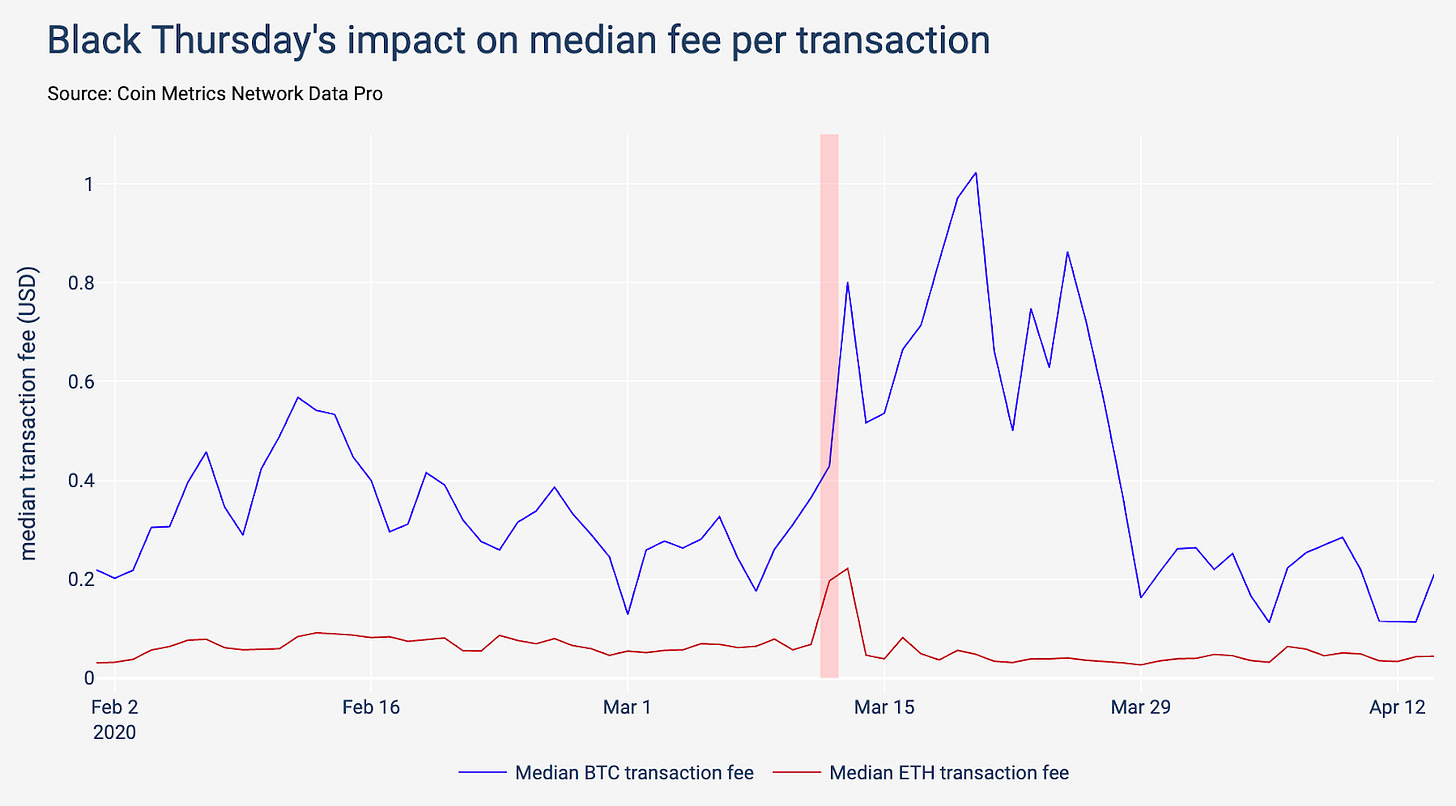

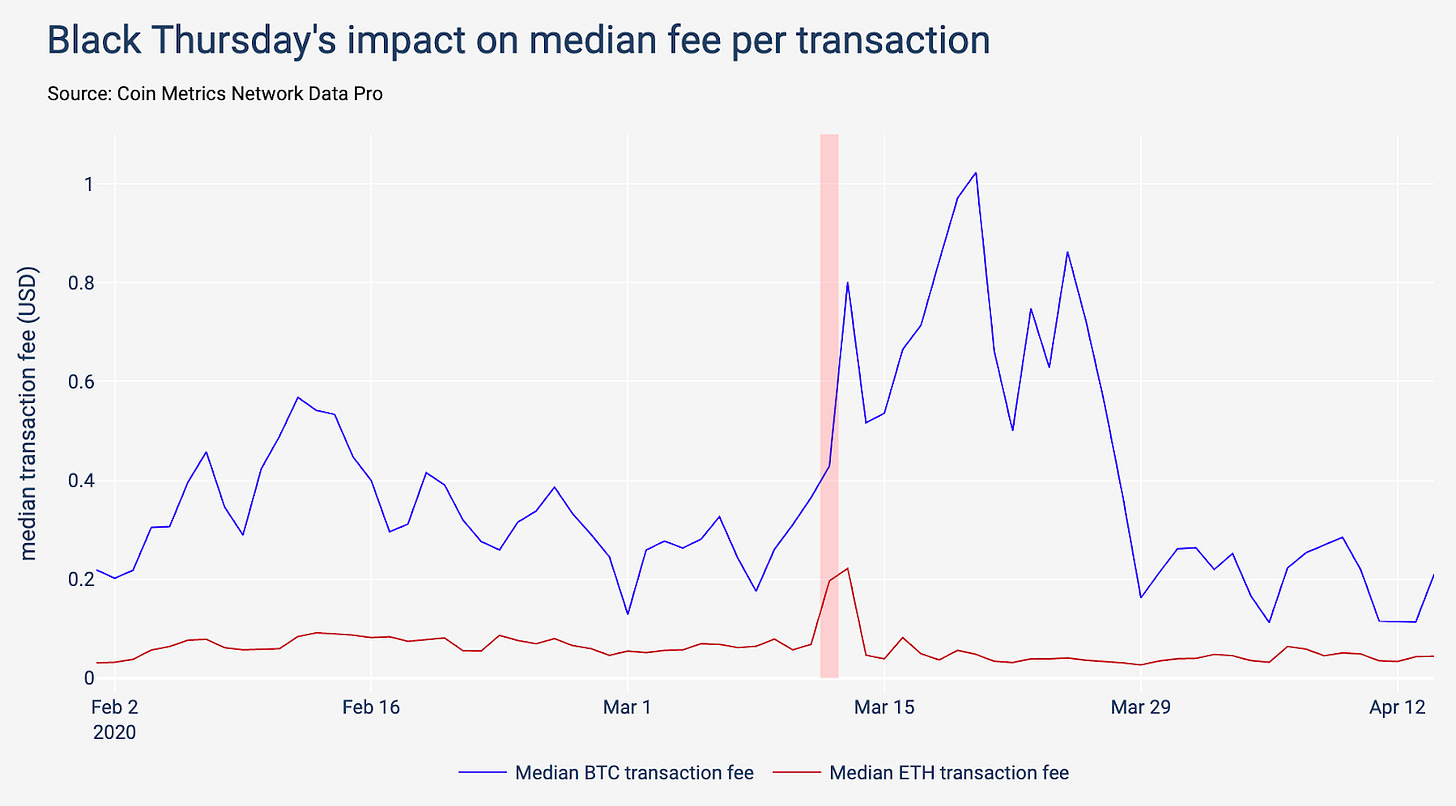

One of the immediate impacts observed on Bitcoin’s on-chain data was with regard to its transaction fees. Bitcoin’s price plummeted down to $3800 and a significant amount of traders were taking their capital in and out of the exchanges. The increased traffic to profit from arbitrage positions led to the demand for block space in the network.

As transactions are generally prioritized based on confirmation from different miners and these miners received a higher fee in terms of incentive. The fee might not depend on the amount of BTC transacted by a sender but it would mostly depend on network conditions and the size of the transactions.

The report stated,

“Most Bitcoin wallets use dynamic fee estimation, and txstats.com’s archives of these estimates allow us to see how they reacted to the increase in activity. Fee estimates for rapid confirmation (10-20 minute wait time) went from 27 satoshis/byte of transaction data to 70 sats/byte in just a few hours.”

It was also noted that the median transaction fee for both Bitcoin and Ethereum had spiked by 5 times in the charts. Although Ethereum’s fees had recovered in a span of two days, Bitcoin’s fee remained at elevated levels for a period of two weeks.

The report suggested that one particular reason for such an effect on Bitcoin’s transaction fee came down to its feedback loop between the different fee estimation APIs.

BitMEX’s experience a major denial-of-service attack, and BTC stopped dropping

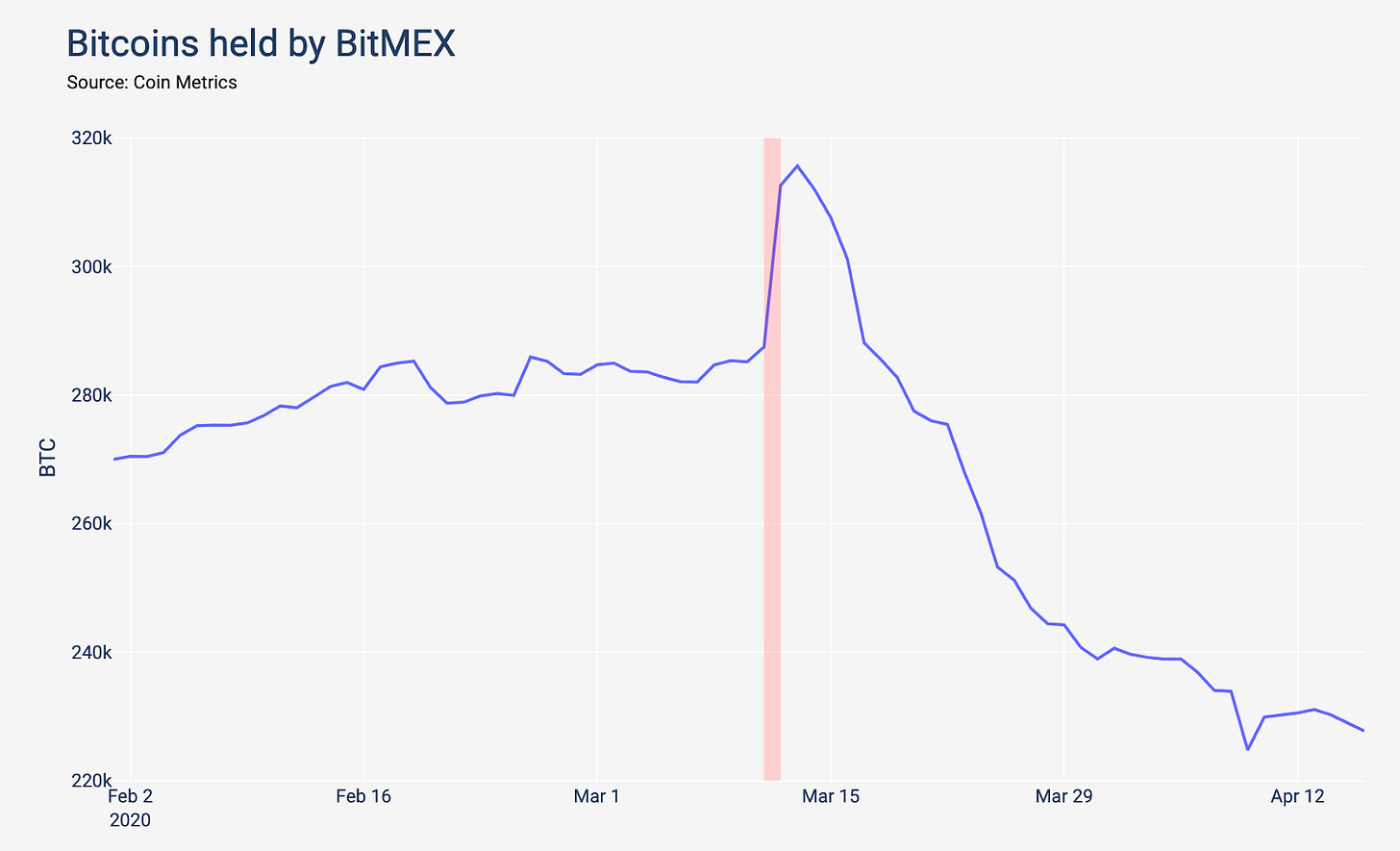

After the collapse on 12th March, BitMEX, the leading Bitcoin futures platform came under extreme scrutiny. The number of BTC accumulated by BitMEX (on behalf of traders) first rapidly increased then witnessed a free fall over the following two weeks, stabilizing recently.

Many speculated that the early increase may have been due to investors depositing BTCs to either trade the very high volatility or add a margin to existing positions to avoid liquidation. In the end, BitMEX ended up losing significant market share as traders were deleveraging and withdrawing their remaining BTC capital on the exchange.

The report concluded,

“Since the crash there has been a reshuffling of the top futures marketplaces for crypto assets with BitMEX losing some of its market share to Binance. This may have an on-going impact across crypto markets, especially considering BitMEX’s outsized influence on price discovery.”